THE DESIGN SPRINT

In this 5 day sprint we created a microsite to help newcomers integrate into Canadian banking seamlessly.

PROJECT TIMELINE

5 days

MY ROLE

UX/ UI Design

TOOLS

Pen & Paper | Sketch | InVision

CLIENT

ThinkBank for BMO

DAY 00 PREPARE

The Client

BMO Financial Group is one of the leading banks in Canada and driven by a single purpose: to Boldly Grow the Good in Business and Life.

As the 8th largest bank by assets in North America, more than twelve million customers count on them for a variety of financial services.

Constraints

Accesibility

This site should be fully accessible and WCAG AA compliant.

Typography

The solution must be designed using Abril Fatface as the headline font and Poppins Light as the body font.

Logo and assets

The ThinkBank logo must be used in the solution and the icon mark should be used as a source of inspiration for the shapes within the website design.

DAY 01 UNDERSTAND

Research

According to an article from CBC, 300,000 newcomers arrive in Canada each year, representing 22% of Canada’s population.

Starting over in a new country is not easy as there are many things that need to be taken care of. Banking is a fundamental first step in establishing stability as a newcomer.

Based on our research the main factors for choosing a bank are: the quality of the service, the rates, the location and recommendations from friends.

We’ve also learned that Trust was a key component when it comes to banking. As a newcomer to Canada, being unable to trust new information was the biggest barrier to starting their financial journey.

Interview Findings

After interviewing 6 participants aged 23-35 (from the Philippines, France, China and Latin America) who went through the same experience as our target audience, these are the insights we found:

- Newcomers are looking for empathy in a financial advisor.

- They want to trust their bank.

- They want someone who speaks their language.

- It is more convenient to use their phone for online banking.

- They lack information about products and services.

Sprint Goals

Primary Goals

To drive increased online sales of the ThinkBank Checking account and the ThinkBank Mastercard.

Secondary Goals

Drive newcomers to the Family Bundle banking package to help users.

Set users up with an in-branch financial planner to help them navigate banking in Canada and set them up with a financial plan.

Defining the Problem

Moving to Canada can be both a daunting and exciting time. There’s so much to prepare for. Out of everything on the list, opening up a bank account can be challenging.

‘Not sure which bank is right for me?’

’Is banking in Canada the same as banking at home?’

ThinkBank would like you to deliver a microsite experience directed at Newcomers to Canada.

A site that makes users feel confident, safe and secure about banking, but more importantly makes them feel excited for their new life in Canada.

The site needs to account for the different needs of newcomers but also needs to be simple and clear so that users feel confident.

Some of the big financial goals for a newcomer are:

- Open a bank account

- Moving money between Canada and their previous home

- Building their credit

- Support from financial advisors

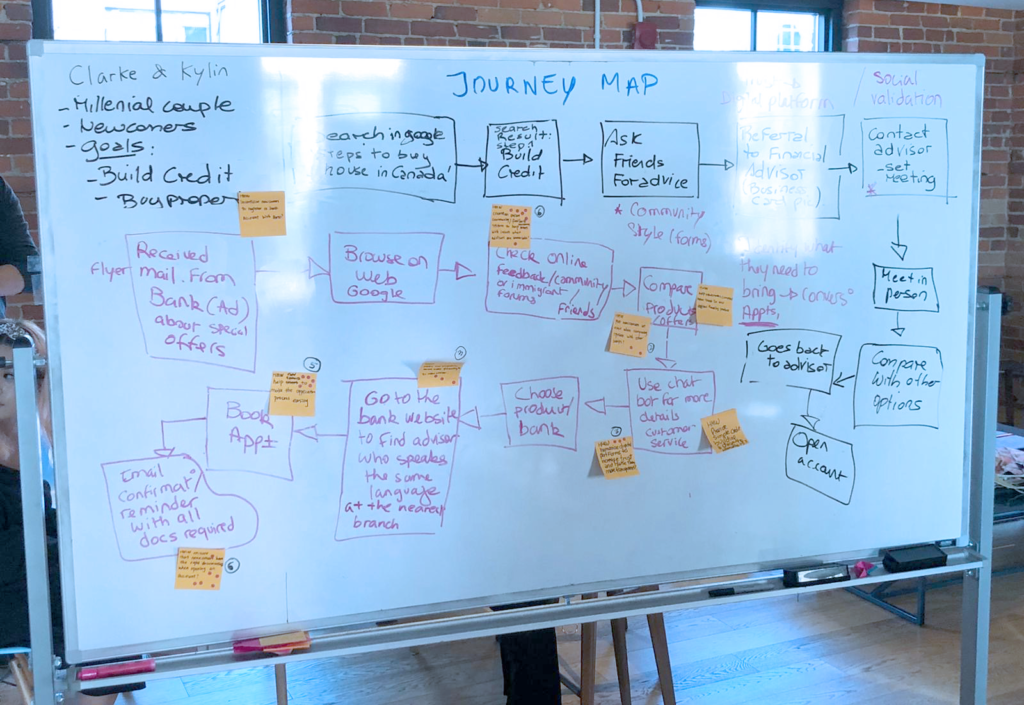

Persona

Young couple – Clarke and Kylin

Clarke and Kylin have just started a new life in Canada. They arrived last week and will need to start a financial relationship as they have dreams to start building a life as soon as possible.

They have sold their apartment back home and will be looking to build credit so the they can be prepared when the time is right to buy something to call their own.

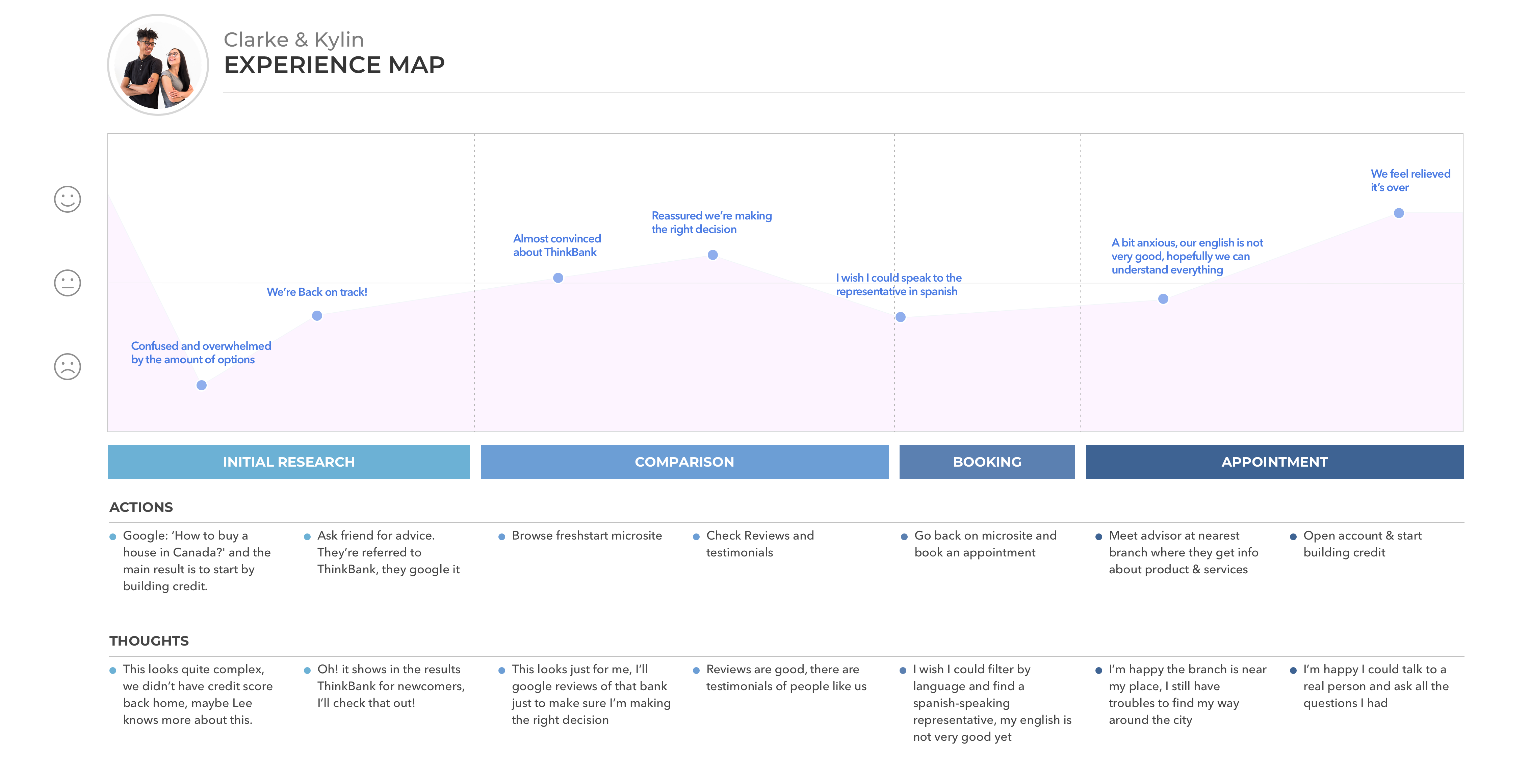

Journey Map

We created 15 steps showing how the user moves through the problem space, starting with their research online to finally booking their appointment with the bank.

The journey map was validated by a BMO representative, who provided additional details and clarity to help us build a more comprehensive understanding of the current state experience.

EXPERIENCE MAPPING

How Might We

The main goal is to help newcomers facilitate everyday transactions and accomplish their ultimate financial goals as smoothly as possible.

How Might We create trust through social validation for newcomers to get banking information?

DAY 02 SKETCH & DECIDE

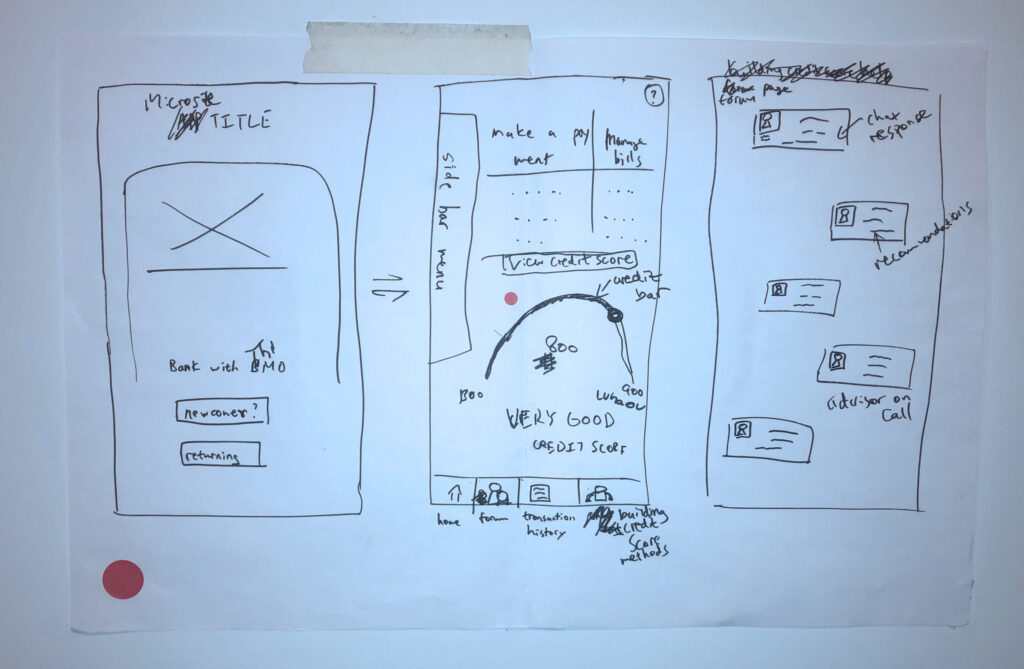

Sketch

Working Individually Together

We generated solutions by sketching on paper, individually, using a four-step sketch approach: Notes > Ideas > Crazy 8s > Solution Sketch.

Each one chose the best idea to render in detail. It had to be self-explanatory and kept as anonymous as possible.

The Chosen Concept

Decision

For the decision making process, we followed four steps

Art Museum

We arranged the solution sketches on the wall chronologically.

Heat Map

We observed the solutions in silence and marked the interesting parts with dots.

Speed Critique

A BMO rep joined the critique session, we quickly discussed the highlights of each solution, reviewed concerns and questions.

Decision

A BMO rep made the final decision on which concept were moving forward with. This prototype would be used for the remainder of the design sprin

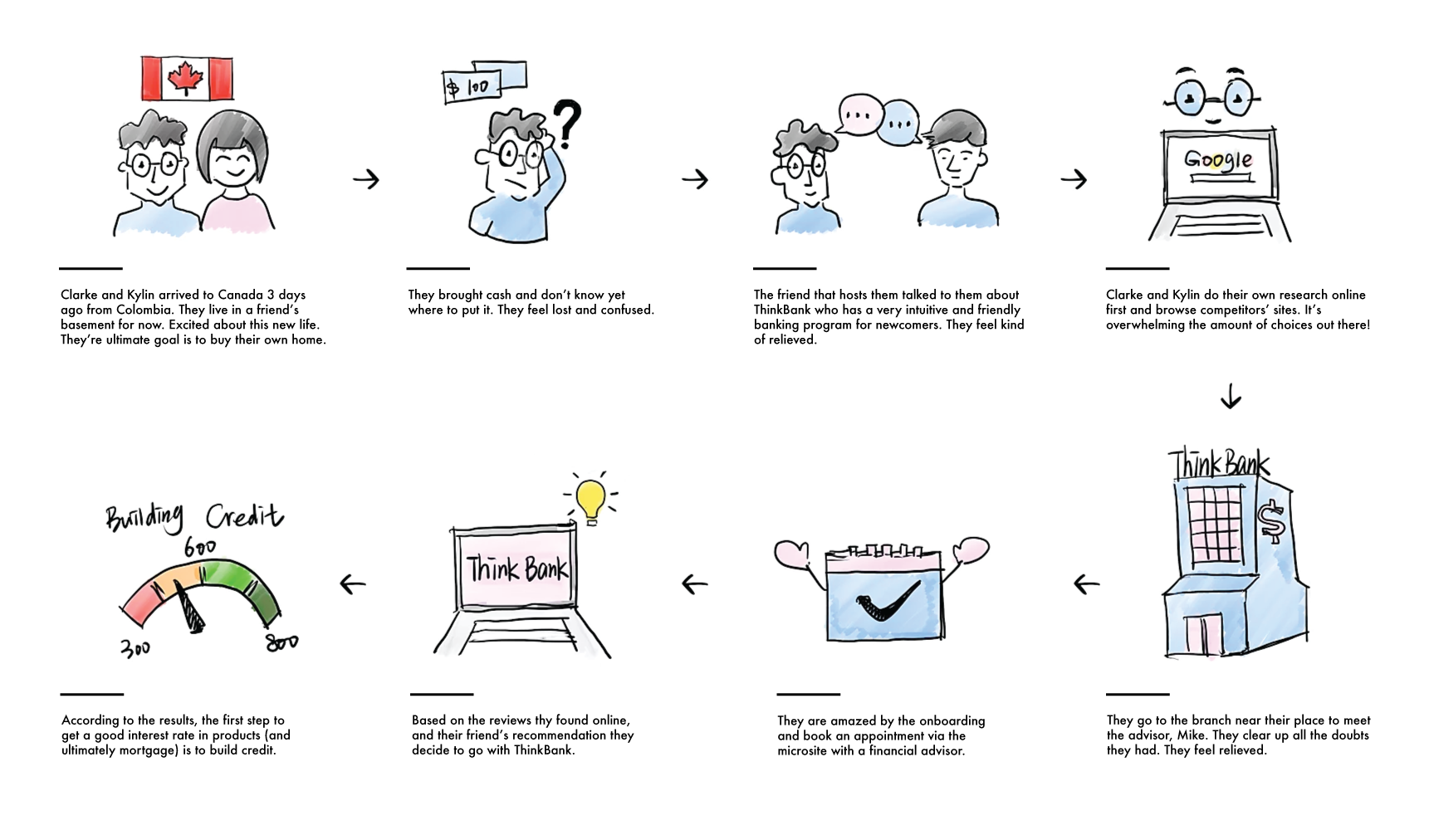

Storyboard

The team’s chosen concept was synthesized into a storyboard, with Long (check out his portfolio) designated as our illustrator.

DAY 03 PROTOTYPE

Mobile Format

The team agreed that the common factor among newcomers was waiting time. As we had to choose either desktop or a mobile platform to develop the concept for, we decided that a mobile option would best optimize their time. A mobile option could be used while waiting in lines or for their name to be called at ServiceOntario.

Prototypes

With the storyboard complete, we translated the solution sketches into a digital prototype.

To build the prototype, we worked collaboratively dividing the tasks. My role was the Stitcher, I made sure that tasks were moving along and that all assets were organized in a way that was easiest for my team mates to pull into the prototype.

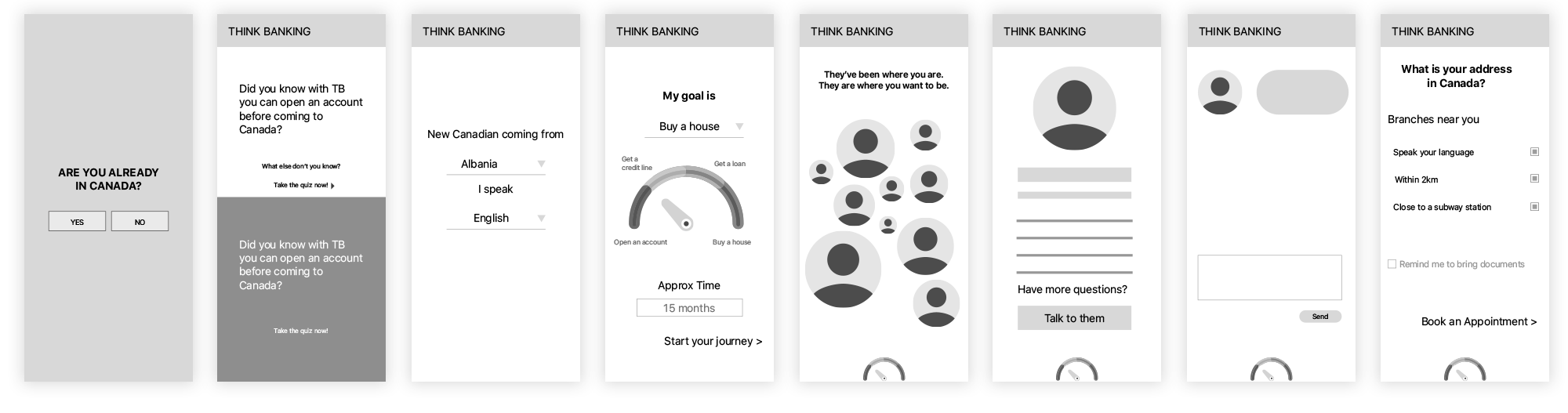

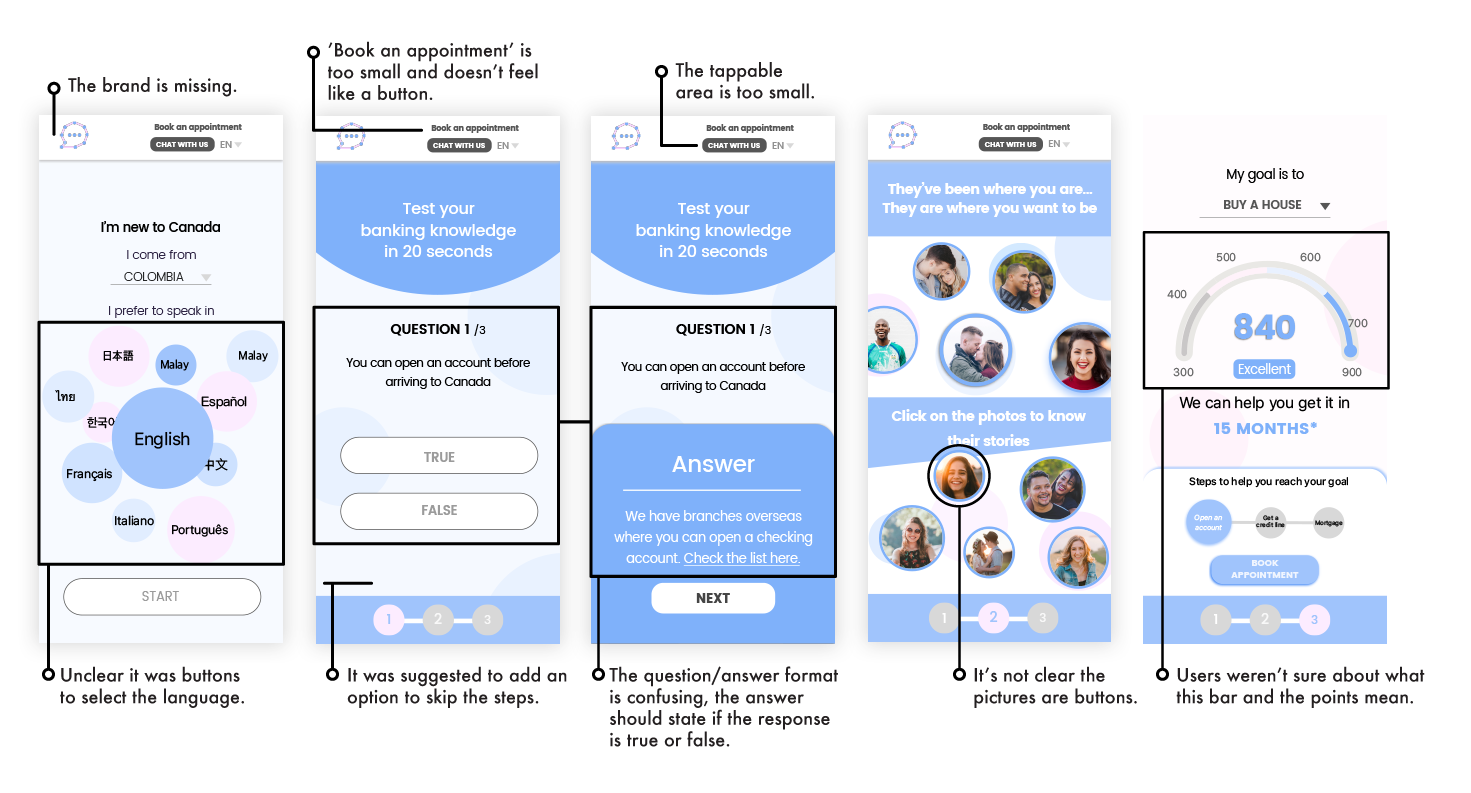

LOW FIDELITY PROTOTYPES

MID FIDELITY PROTOTYPE

DAY 04 VALIDATE

Usability Testing

We performed 2 rounds of usability testing and came to the following conclusions:

Heuristics

For the interactive pages, some of the users found them to be unintuitive due to labeling or sizing of fonts.

Hierarchy

Information architecture for the advisor page was confusing because the products listed under the testimonials looked clickable.

Accesibility

- Our microsite is WACG-ADA compliant for users:

- Content accessible with keyboard only

- Contrast, font and colours

- Audio accessible

DAY 05 PRESENT

The Solution

We created a potential solution to help newcomers like Clarke and Kylin transition into Canadian banking. We presented this solution to a panel from BMO including representatives from the marketing and design teams.

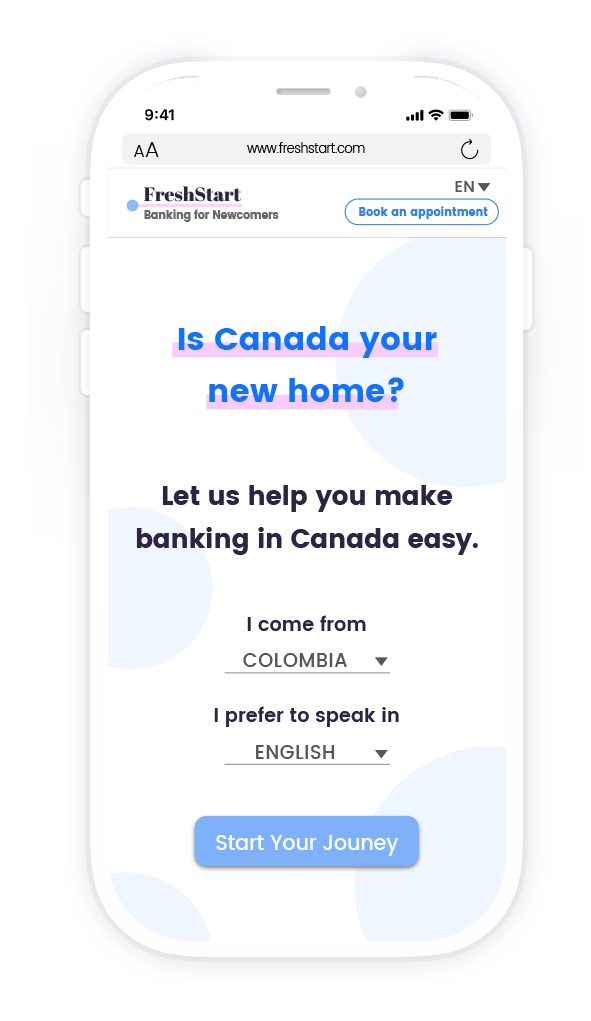

#0 ONBOARDING

We start by asking them where they’re coming from and what language they speak, in order to customize their upcoming experience with us.

We reduced the experience into a four step journey to start banking.

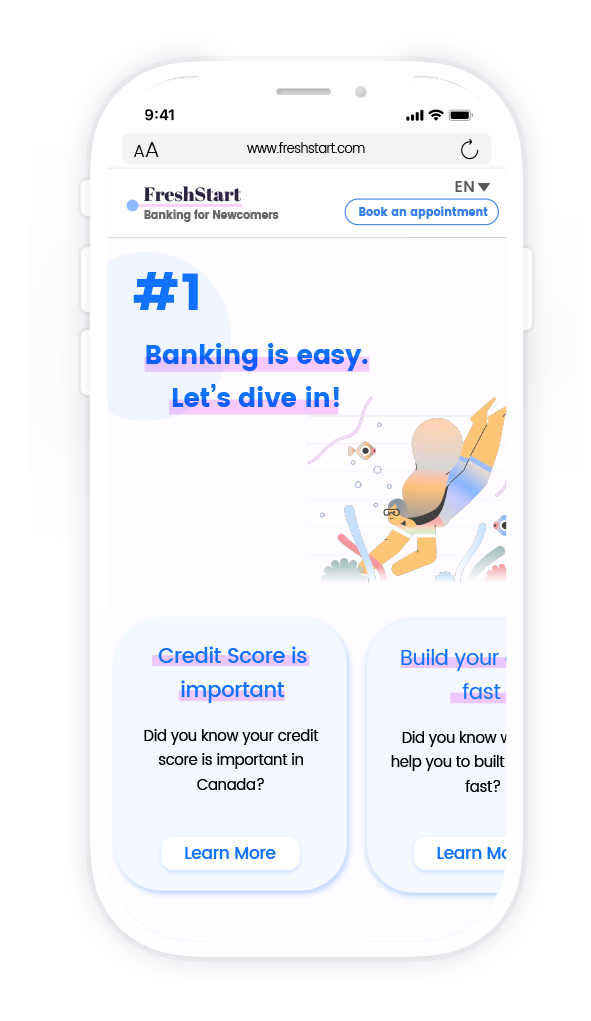

#1 EDUCATE THEM

The first step is to educate them about the basics. It’s banking 101, information that many Canadians would know at their age, but Clarke and Kylin don’t have as newcomers. What is a credit score and why is it important? How can I make it better? What’s the difference between checking and saving accounts?

#2 CREATE TRUST

The second step is to create trust by showing them success stories from people that share a similar background. Seeing others who have similar goals and dreams when coming to this country also creates a feeling of community, not just a transactional relationship.

They can read the story of John and Emily for example: the goals they had when they came to Canada, their advice for newcomers, what products they have with ThinkBank and even the contact information of their financial advisor in case they want to contact them directly. Here they can get in touch with this couple and ask questions. They’ve found people that they share language, values or a similar background with who are currently partnered with ThinkBank. At this point, they can also book an appointment with ThinkBank and if they’re not completely sold on the idea, they can go back to the main screen.

#3 SET A GOAL

The third step is to set a goal. It could be saving up for later, buying a car or in the case of Kyle and and Kylin, to buy the new house. In a graph, we showed them that they need a credit score of 700 points in order to get a low interest mortgage rate. And we can show them how to reach these goals in the shortest time possible… How? We are going to help them each-step-of-the-way. From opening an account, getting a credit card, recommending them to set automatic bill payments, advising them when to get a small loan or a line of credit, and any other product that can help them build their credit faster and achieve their dreams.

#4 BUILD THEIR FUTURE

The fourth and last step is to encourage them to talk to an advisor to start building their future today with ThinkBank.

Next Steps

- More usability testing rounds

- When booking an appointment: choice of advisor based on language, location, reviews

- The referrals show current customers who were in similar positions as newcomers and they were willing to share their success stories with newcomers to help spread the community

- Social referral program leading to perks (e.g. offer credit card with a small limit to start building credit score)

- Documents reminder for appointments by email and by text to avoid drop-offs